So, I’ve been turning this over in my head for a while and just need to nerd out with y’all for a second. There’s something we need to talk about, and I promise it’s juicier than your typical fashion forecast.

Let’s be honest: navigating the world of plus size fashion investment can feel like trying to strut in stilettos on gravel. If you’re a plus size founder trying to build something beautiful, bold, and community-driven… and you’re hitting brick walls when it comes to funding? You’re not alone. We see you, we feel you, and we’ve got your back.

This isn’t just another thinkpiece full of stats and polite suggestions. No ma’am. This is a come-to-the-table moment. We’re talking about real barriers, real bias, and the real billion-dollar opportunity that’s been hiding in plain sight. We’re going to pull back the curtain on why plus size fashion has been overlooked by investors, why so many of our faves are forced to bootstrap and then close, and what it’s going to take to flip the script.

Whether you’re a founder trying to figure out your next move, an investor curious about the space, or just someone wondering why your size is still considered an afterthought… you’re in the right place. We’re walking through this together. You’ll leave this read feeling clearer, bolder, and way more equipped to advocate, invest, and show up in a space that’s long overdue for its moment.

So, grab your coffee, your notebook, or your favorite lip gloss… we’re getting into it.

Why Is It So Hard for Plus Size Founders to Get Funding?

If the plus size fashion investment space is clearly thriving and the market demand is there, why are so many plus size founders still struggling to secure funding? The truth is layered; and it’s not just about the money. It’s about who investors expect to see at the table, and what kinds of businesses they consider “serious.” Spoiler alert: that bias runs deep.

Let’s start with the big picture. For years now, women, especially women of color, have received just a fraction of venture capital funding. Female-only founding teams historically receive just 2–3% of all VC capital, according to PitchBook and 4Founders Forum; and that stat hasn’t budged much. In fact, across the past 30 years, women-led startups have averaged just 2.4% of total venture funding, as reported by the Harvard Kennedy School.

Even in 2025, when women-led exits nearly doubled, the actual amount of money flowing into female-founded businesses still hovered around that same tiny 2% mark, according to Female Founders Fund.

But it doesn’t stop at gender. Now layer in appearance bias… something most investors won’t admit, but that shows up in decision-making every day. Studies have found that female founders often receive 14% less funding than male founders for the exact same pitch. That gap widens to 22% less if the investor has had a negative experience with a woman-led startup before, according to Yale Insights.

This is where things get even messier for plus size founders. Venture capital is built on “pattern matching”; in other words, investors fund what looks familiar. And unfortunately, the typical “founder image” they’re used to? White, thin, male, hoodie-wearing, and straight out of Stanford. If you don’t match that mental mold, you’ve got an uphill battle before you even open your pitch deck!

More dauntingly, for plus size women, the challenges are doubled. You’re facing gender bias and weight stigma; an invisible but powerful barrier that many founders don’t even realize they’re up against. Investors might not say it out loud, but when a plus size woman walks into a pitch room, she often has to prove not just her business case, but her competence, her commitment, and her right to be taken seriously. There’s a deep, unspoken question of whether she “fits” the founder archetype; and that’s the kind of coded thinking that keeps capital out of reach for game-changing ideas.

Now, you might think, “Well, what about female investors? Wouldn’t they be more open to backing other women, especially those innovating in the plus size space?” In theory, yes. But in practice, there’s a frustrating paradox.

Some studies show that when women are funded by female investors in their earliest rounds, they’re actually less likely to raise follow-on capital compared to those backed by men.

Why? Because of perception bias.

Other investors may assume that the original investment was made based on affinity rather than merit; casting doubt on the business instead of reinforcing it. It’s a twisted double bind: you’re too “different” for male investors, but funding from women doesn’t always carry the same clout in follow-on rounds.

All of this makes bootstrapping the default path for many plus size fashion founders. With traditional capital so hard to access, most turn to personal savings or side hustles to launch their brands. According to the Female Founders Fund, the average startup loan approved for a woman is just under $60,000, while the average for male entrepreneurs is more than $156,000. That’s not a small gap; it’s a canyon.

Without early capital, these founders often grow slower, take on more risk, and miss critical windows to scale or expand before competition floods in.

And then there’s the final kicker: misclassification. Investors often don’t know where to “place” plus size fashion brands. Many lump them into the traditional retail category; low-margin, inventory-heavy, seasonal, and risky.

These investors don’t see the tech-enabled innovation, the scalable potential, or the cultural shift powering this movement. They might also assume that size inclusion is a fleeting trend, rather than what it actually is: a long-overdue industry correction and a consumer demand that’s here to stay.

And while we’re here, let’s talk about consolidation. Over the past few years, some of the most recognizable plus size retailers have been acquired, merged, or absorbed by larger retailers and VC firms. From a capital and growth standpoint, that signals clear market value. But for indie designers and small brands, it raises some big questions.

What happens when the giants buy up the space? Does it limit innovation or make it harder for newcomers to carve out room? Or does it create fresh opportunities for niche voices to offer what big brands still can’t, authenticity, community, and style that actually fits?

Because let’s be real, when everything gets corporatized, consumers start craving something real again. And that’s where smaller, founder-led brands shine. But to compete, they need more than sales from us in the plus size fashion space, they need capital… and the proper room to grow.

And because they don’t understand the space, some investors incorrectly label these brands as “boutique” or “niche,” despite the fact that we’re talking about a multi-hundred-billion-dollar global market.

So, to recap? Plus size founders are walking into rooms built to overlook them; carrying businesses with massive upside, while having to jump through hoops no one else even sees. The deck is stacked, but the game isn’t over. It just means we’ve got to play it smarter, louder, and more unapologetically.

And we’re gonna help you do exactly that.

What Founders Need to Know (and How to Show Up Ready)

First things first: your business is not a pity project. It’s not a charity case. Your brand belongs at the investment table just as much as any tech bro with an app that does the same thing five others already do. So how do you get investors to see that? Let’s talk strategy.

You need to know your numbers; not just the cute customer count or your latest social media reach, but the big-picture market story. This industry is growing. The global plus size clothing market was valued at over $311 billion in 2023, with projections that it could reach $412 billion by 2030, according to Grand View Research. Some forecasts are even more aggressive; Allied Market Research predicts this market will cross $960 billion globally by 2033. That’s not small; that’s serious growth.

And yet… investors are still treating it like an afterthought.

Founders, your job is to bridge that knowledge gap. Bring the receipts. Talk about customer retention, average order value, repeat purchase rates, and how you’re not just building a brand; you’re building a community. And that community? They spend. They advocate. They stay loyal when they feel seen.

Also, it’s not enough to say you serve the plus size customer; you need a unique angle.

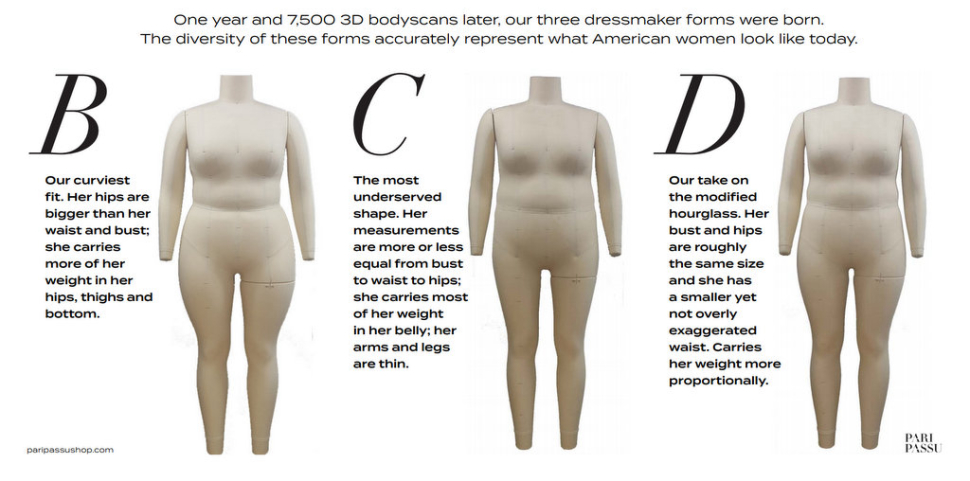

Are you doing fit innovation? Custom fabrics? Inclusive sizing across trend categories no one else touches? Is tech part of your offering? Think digital fit tools, virtual try-ons, data-driven size prediction. These things set you apart and make your brand more investable.

Most importantly, don’t wait until you need money to start investor conversations. Build those relationships early, like now. Follow investors who focus on inclusion, the future of retail, or consumer tech. Get warm introductions. Practice your pitch. Show traction. And be clear about what you’re asking for, why, and how that capital will help you scale smart.

And a quick tip: be ready to challenge the assumptions in the room. Some investors may assume your customer isn’t aspirational or that plus size equals discount-only. That’s where you come in to reframe the narrative. The plus size shopper wants luxury. She wants trend. She wants elevated basics, statement pieces, and high-touch service. And she deserves all of it.

But What About Ozempic?

Yes, let’s go there… because we know someone’s already whispering about it. With the rise of GLP-1 medications like Ozempic and Wegovy, there’s been a lot of noise about what this means for the future of plus size fashion. Will the market shrink? Will demand fade? Is this the beginning of the end?

Deep breath: We’ve been here before.

Remember phen-phen? SlimFast? Atkins? Every decade brings a new “solution” to fatness, and every time, we see the industry panic… and then bounce back. Because here’s what doesn’t change: bodies come in all sizes, people will always need stylish, well-fitting clothes, and weight loss trends don’t erase the need for fashion that centers and celebrates everyone.

Now, don’t get it twisted… GLP-1s are definitely impacting the retail landscape. According to Impact Analytics, over 400 million units of apparel could be misaligned in the next few years if brands don’t adapt their size curves. And yes, size mix strategies are already shifting; what used to be a 1-2-2-1 (small to large) ratio is leaning more toward 2-2-1-1, because smaller sizes are selling faster.

Big brands are reacting. Some are scaling back plus offerings or restructuring them completely. But industry experts are pushing back hard. Mallorie Dunn, a fashion professor at FIT and designer behind SmartGlamour, told CNBC: “Retailers and manufacturers should absolutely not be making less plus size clothing because of GLP‑1 drugs… plus size customers are grossly underserved as it stands.” She also pointed out that while 68–72% of U.S. consumers wear plus sizes, the category only accounts for 12–18% of revenue in many cases.

So no, plus size fashion isn’t on its way out; it’s evolving, as it always has. And if anything, now’s the time to double down on innovation, fit technology, and inclusive design. Because no matter what the headlines say… this is still a multi-billion dollar market.

Why Investors Need to Rethink the Plus Size Fashion Space

If you’re an investor and you’ve made it this far, thank you. Now let’s talk about why your portfolio might be missing out.

There’s a major disconnect between what the market wants and what gets funded. While more than 68% of U.S. women wear a size 14 or above, only a sliver of brands cater to them with style, consistency, and care. And when new brands do try to launch, they often lack the capital to scale. That’s a lose-lose for both sides.

By overlooking plus size fashion, investors are walking away from a high-growth, high-loyalty, and massively underserved consumer group. And that’s not just bad business; it’s a missed opportunity for impact and innovation. Plus size founders bring lived experience, untapped ideas, and a direct line to an audience that’s ready to spend.

Backing a brand in this space isn’t a charity move; it’s a power play. It’s smart. It’s future-focused. And it’s exactly where your dollars can create real disruption. So, get curious. Ask questions. And start betting on founders who don’t look like the last ten you backed.

And hey… if you’re not sure where to start? That’s where I come in. As a strategic consultant and the force behind The Curvy Fashionista, I am here to help investors and brands get up to speed, see the white space, and tap into this game-changing market. Call me. Hire me. Let’s talk opportunities, impact, and how to make your next move in this space your smartest one yet.

The Future Is Curvy (and Fundable)

The truth is, the plus size fashion world is more than ready. Founders are building. Shoppers are spending. The runway is slowly catching up. And now, we just need capital to catch the hell up too.

Whether you’re a founder mapping your next move or an investor wondering where the white space is… this is it. The market is massive. The community is loyal. The stories are compelling. And the ROI? If you play it right, it’s generous.

The time for change isn’t down the road; it’s right now. So, let’s fund boldly. Let’s build differently. Let’s finally give plus size fashion the investment energy it deserves.

Because this isn’t just about fashion; it’s about shifting culture, centering inclusion, and making space where there’s been silence.

Let’s mind our business… and make it inclusive, profitable, and powerful.